From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

Read MoreThe first part of our Generative AI series covers the opportunities and risk, the second part discusses Gen AI applications for asset allocators and asset managers, and the last part would be Gen AI applications...

In our latest article, we share insights into how wealth management firms are building private markets capabilities and what role technology plays in their strategy

DiligenceVault and Shadmoor Advisors co-hosted a panel covering the state of cyber threat and views on Generative AI for the financial services industry in London on May 18th, 2023. We were joined by cyber and...

Key insights from PEI Investor Relations, Marketing and Communications conference in New York City. Highlighting best practices and trends impacting today’s IR landscape.

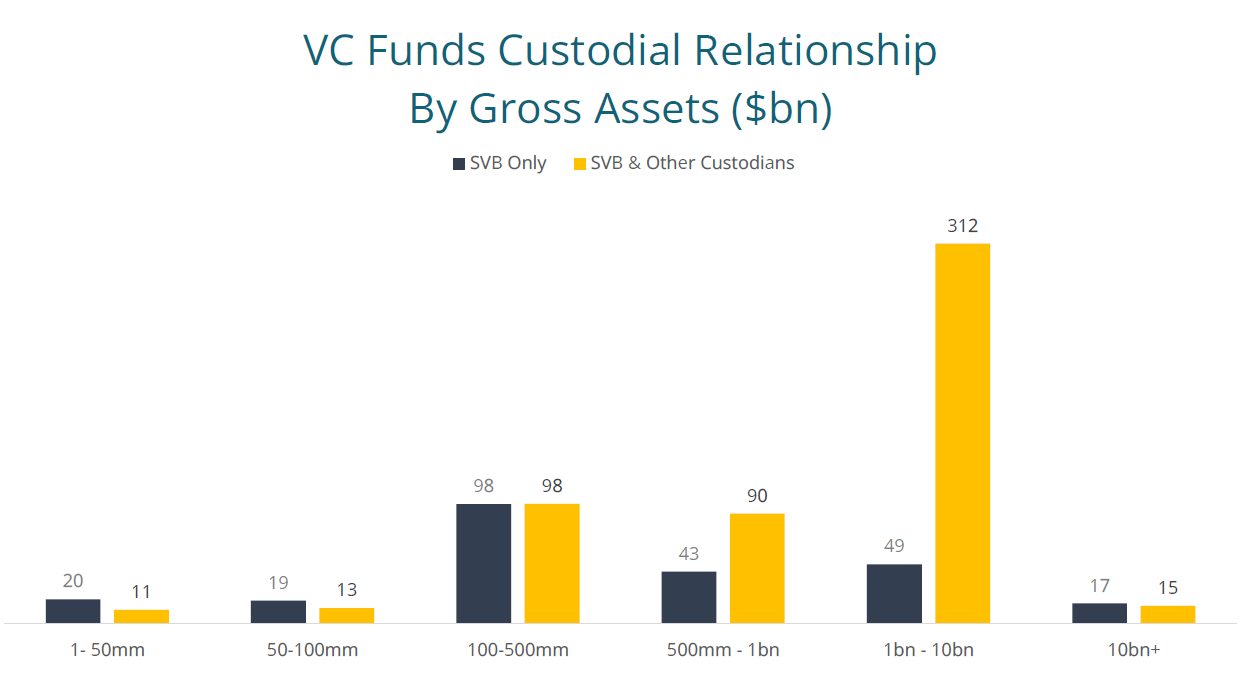

With regard to the latest market events around Silicon Valley Bank, Team DV brings you a few resources with insights on how our technology can support your due diligence program.

Read our latest blog on building fund marketing strategy to ensure your firm and product profiles are available in the right database, for the right target audience, and at a higher quality than before.

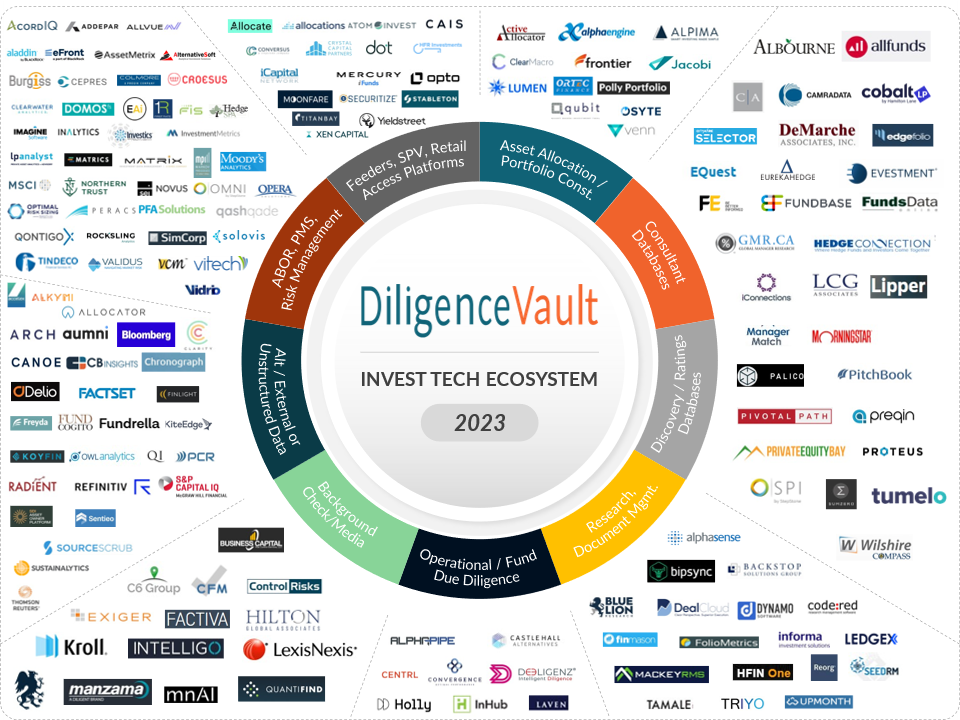

In the 2023 InvestTech map for asset owners and allocators from DiligenceVault, we discuss 10 industry and InvestTech themes that drive the year of Big and Bold!

We are grateful and privileged to experience the milestones and learnings from this chaotic year 2022! Take a peak at our journey!

See how tech can help with portfolio exposure data collection and how clients responded to market moves around Credit Suisse and long term Gilt yields.