From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

Read MoreManCos have a responsibility to identify and assess all risks from their investment management delegation. How does digital diligence help ManCos meet regulator’s expectations on delegate oversight?

Get to know the individuals comprising the DiligenceVault team as we commemorate the rich tapestry of culture, varied experiences, and diverse thought processes that form the essence of our organization.

(DDP) is built specifically for the investment management industry, these tools have greater emphasis on continuous usage, collaboration, security, importing and exporting abilities and data analysis.

The digital diligence platform (DDP) is a foundational tool for an asset allocator or investor. At DiligenceVault, we think it's an exciting category in the industry! It's more than one of those Saas-y fintech acronyms...

Is diligence similar to dating? Think about it: Two parties meet, exchange information, and make a decision to commit or not. Similarly, a type of diligence occurs when a person is buying a house or...

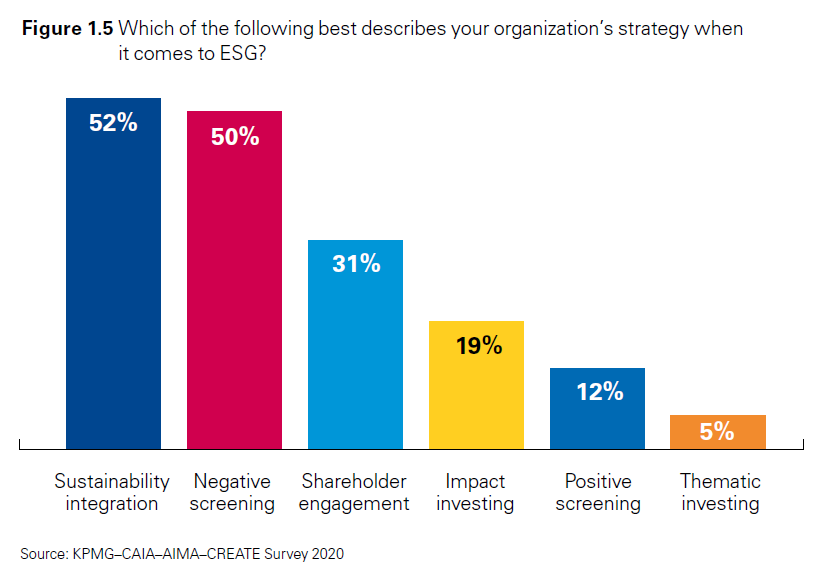

Sustainable investing, ESG integration, and impact investing all have their own distinct meanings but one thing rings true – it is a pre-requisite knowledge for the investors of the future as it is capturing the...

Over a month ago, DiligenceVault expanded into the EMEA region with the hiring of our newest Vaulter and EMEA Business Development Director, Guillaume Rouault. Guillaume has made an immediate impact on the team with his...

These past two months have been like nothing else we have seen in our lifetimes, and we at DiligenceVault are sharing some learnings and perspectives to help one another. Here at DV, the entire team...

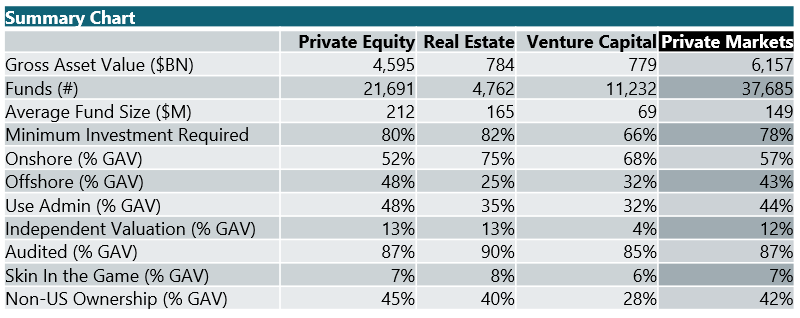

What Public Data Tells Us About Private Market Funds