From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

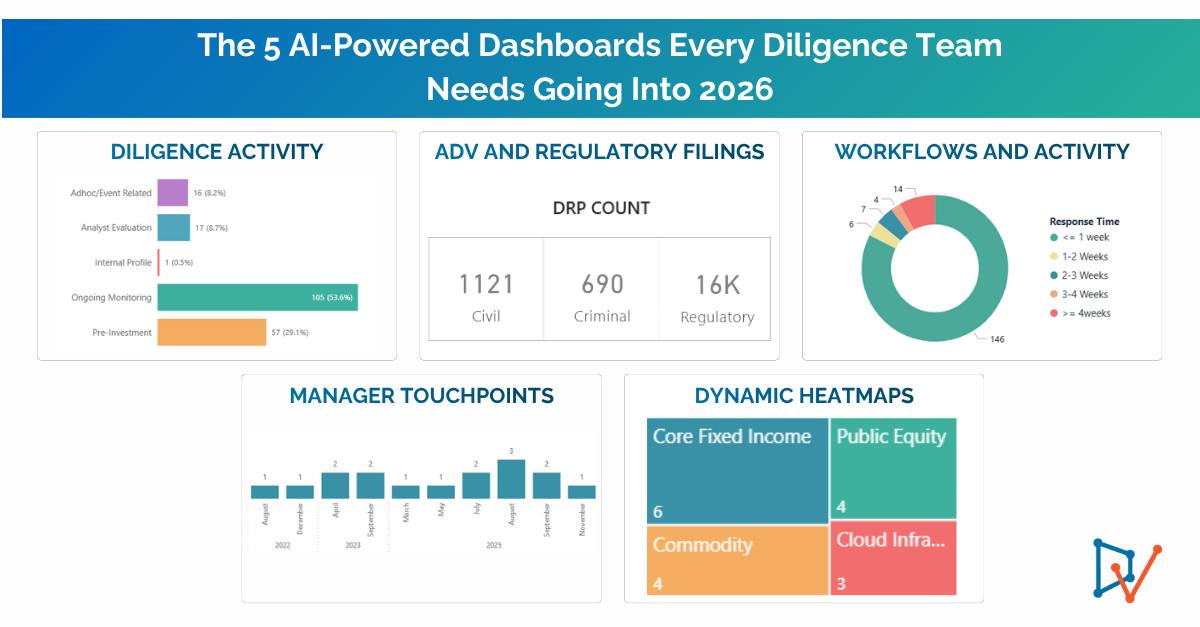

Read MoreIf 2025 felt reactive, 2026 demands clarity. This is Part One of our series detailing the 5 AI-Powered Dashboards that serve as the operating system for modern diligence. Discover how to move from information overload...

The real fear in due diligence isn’t bad data, it’s false confidence in data that looks right but isn’t verified. Discover how DiligenceVault transforming scary data into credible insight through structured workflows and transparent AI.

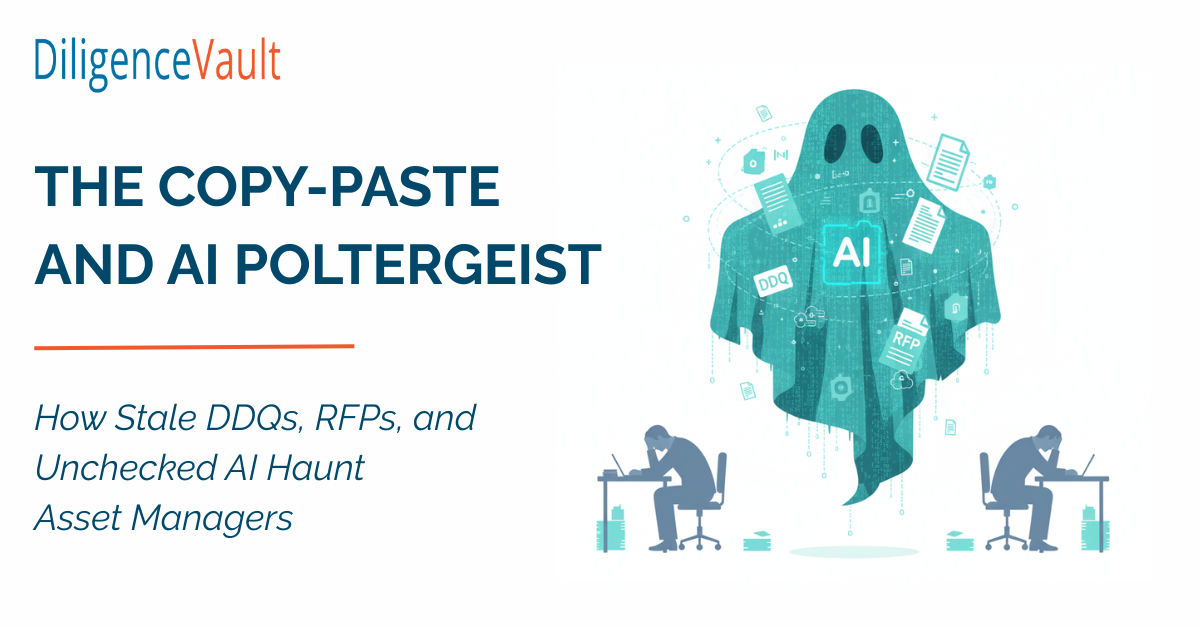

From stale DDQs to AI-generated ghost files, asset managers face recurring nightmares. Explore how DiligenceVault’s intelligent workflows replace the copy-paste chaos with AI-Powered intelligence, ownership, and auditability, turning haunted processes into controlled ones.

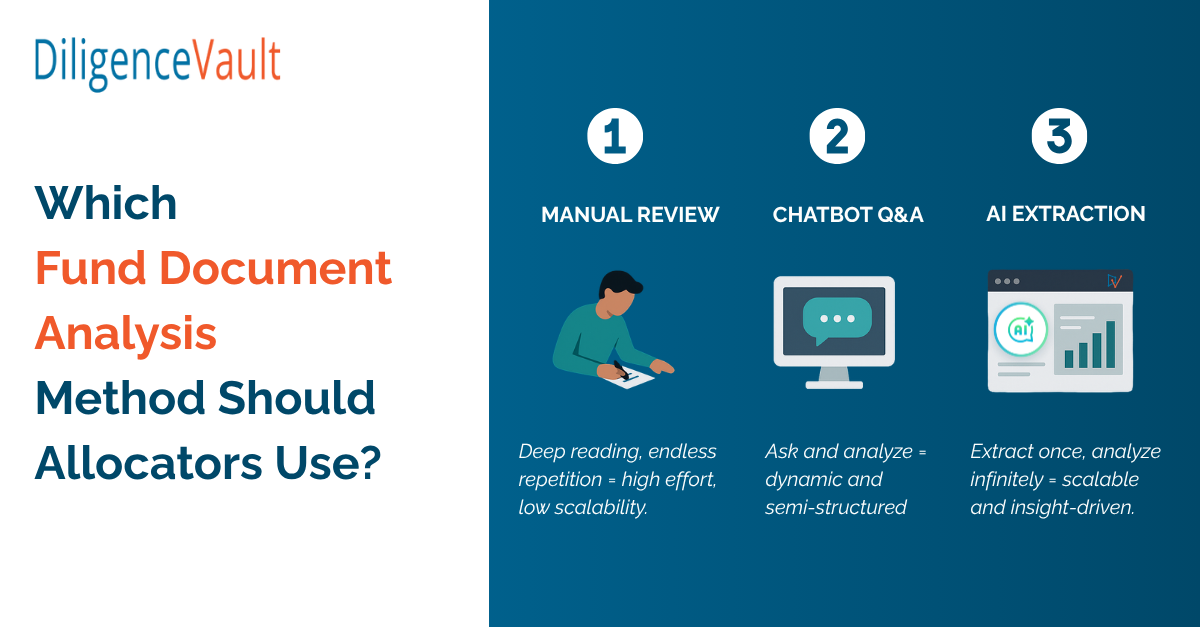

From manual review to AI dashboards asset allocators are rethinking fund document analysis. Explore how manual diligence, chatbot Q&A, and AI-driven extraction methods compare in cost, scalability, and insight with DiligenceVault's latest blog.

Discover the Key takeaways from AIMA Australia Annual Forum 2025, $250B private credit, CPS 230 readiness, allocator sentiment, and how AI is reshaping alternatives.

AI has transformed grunt work into growth work. Learn how AI-native analysts are reshaping careers, training, and talent in asset management.

Discover how the $700B evergreen fund boom is reshaping private markets and why investors need sharper due diligence to evaluate these structures.

Your step-by-step strategy for building LP trust, standing out, and raising smarter with AI

Streamlining Due Diligence with AI for Smarter Investment Decisions