From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

Read MoreExplore top insights from the 2025 ICI Investment Management Conference, focusing on SEC priorities, fund governance, AI, DEI, Governance and more.

Catch up on the most talked-about ODD trends from Q2 2025, straight from our conversations with 22 industry peers at the NYC Roundtables.

The asset management industry faces massive inefficiencies due to a lack of standardization across reporting, due diligence, and data management. In this blog, we break down the billion dollar problem around the lack of standardization.

Read our blog to discover how InvestTech 2025 brings innovation, opportunities, and transformation to technology and investment management.

Read the blog and explore the key operational due diligence trends for 2025, featuring insights on AI, cybersecurity, ESG, and vendor risk management.

As 2024 takes its final bow, we can’t help but feel grateful for a year that was. 2024 wasn’t just a sequel; it was an evolution, a masterpiece crafted with intent, growth, collaboration, and steadfast...

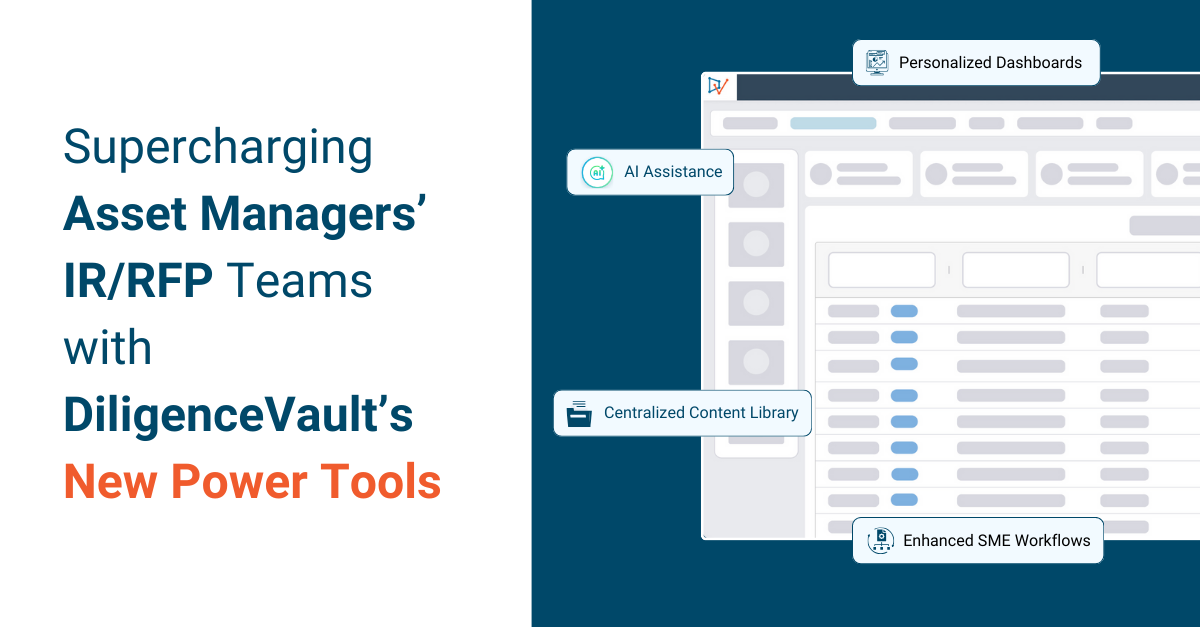

Read the blog to streamline IR/RFP workflows with DiligenceVault power tools and smart features. Stay organized and drive efficiency!

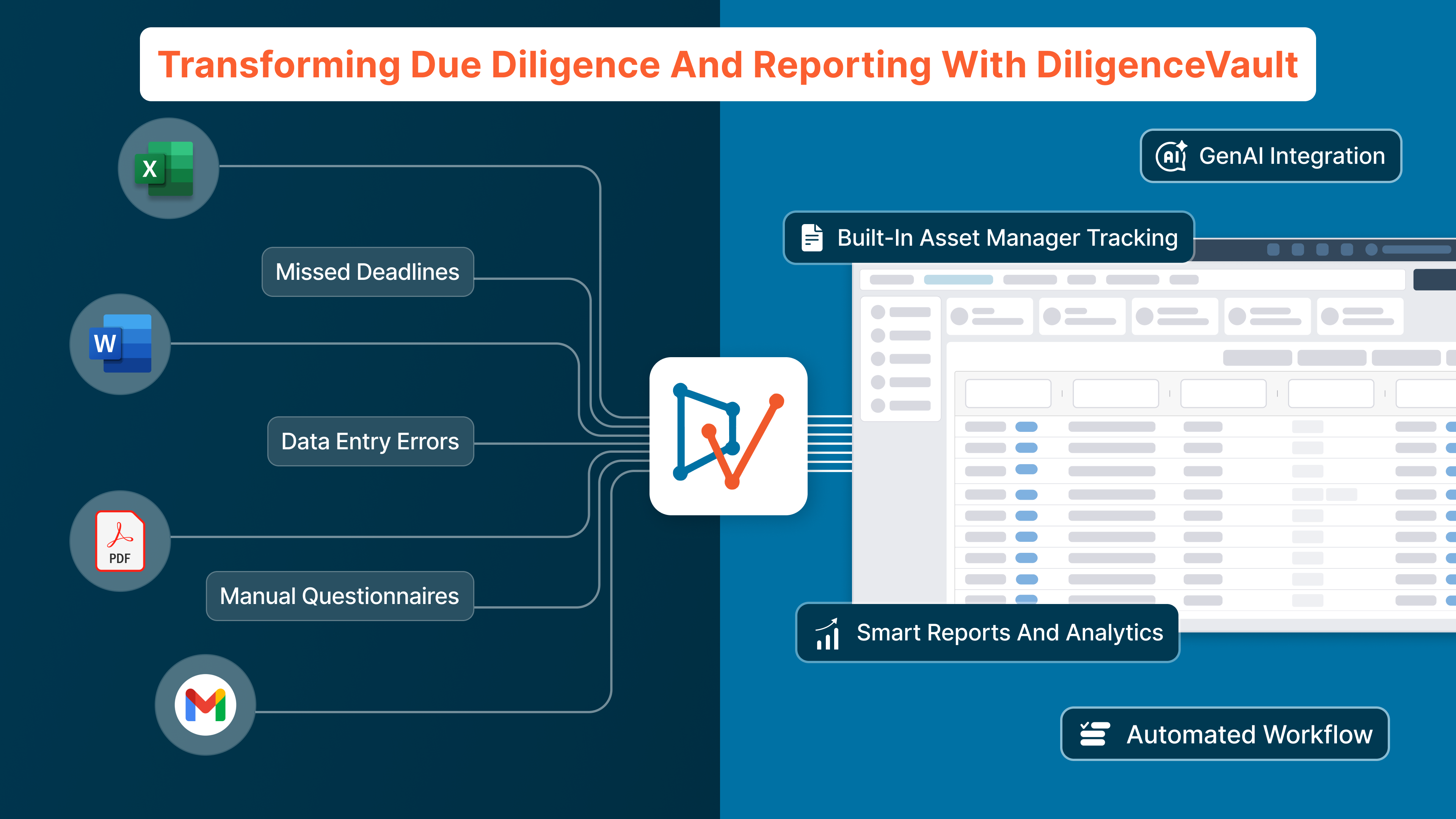

Explore the blog to see how DiligenceVault is transforming due diligence and reporting with its all-in-one solution for allocators.

Read the takeaways and insights from our team who recently attended the GAIM Ops West 2024 in Carlsbad, CA.